Weekly Digest

5/26 - 5/30

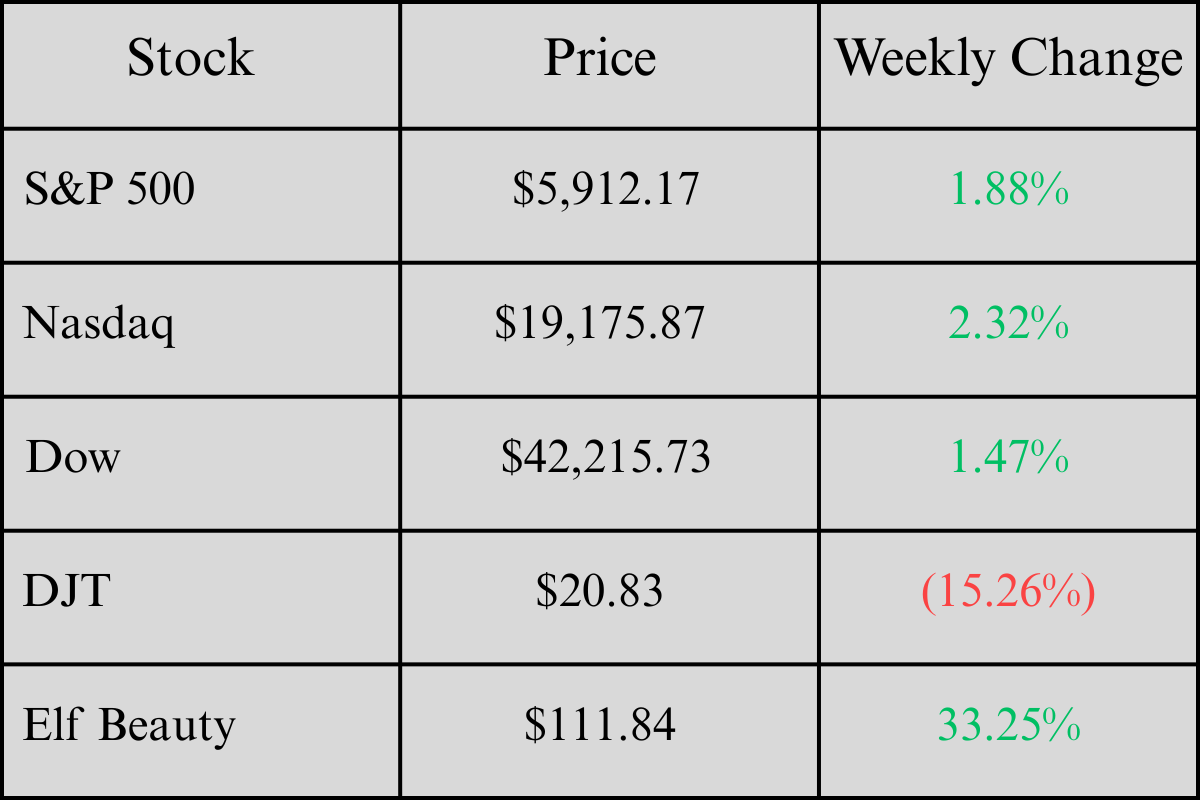

Markets

Macro

The market continues its rebound, gaining back losses from Q1. This is led by chip maker Nvidia, and positive development in trade negotiations. Nvidia continued its growth, almost doubling its revenue from Q1 of 2024, reporting $44.1 billion. Trump has been held off from imposing major tariffs on international trading partners.

Market Intel

Top-Heavy S&P 500

The S&P 500 has become increasingly top-heavy as its top 10 companies represent over 30% of the index’s value. This raises concerns for long-term investors who may be hurt by the recent decrease in index concentration. While short-term investment can see immediate upside, investors must consider whether the S&P represents a diversified index or if it is more of a wager on its top holdings. Long-term investors should consider exposure to multiple asset classes based on their risk profile. Full Story.

A Pretty Penny No More

After more than two centuries in circulation, the U.S. Treasury has announced plans to cease production of the penny by early 2026. The decision is driven primarily by rising production costs and the declining utility of the lowest-denomination coin. Each penny now costs nearly 4 cents to produce, resulting in an estimated annual loss of $85 million for the U.S. Mint. Full Story.

Private Credit Growth

This industry has seen extreme growth in recent years, now valued at over $2 trillion, and will continue to see growth with projections of $2.8 trillion by the year 2028. While private credit offers value in a world of tight bank lending, its growth is raising some concerns. Small and mid-sized companies are benefiting from access to capital, but at what cost? Full Story.

Salesforce's $8 Billion Acquisition of Informatica

On May 27, 2025, Salesforce and Informatica announced they had come to an agreement in which Salesforce will acquire Informatica for $8 billion. Current terms establish that holders of Informatica Class A and B-1 common stock will receive $25 per share held. This strategic acquisition will enhance Salesforce’s trusted data foundation. The combination of Informatica’s rich catalog and metadata management with Salesforce’s platform will enable all AI agents to operate efficiently and be scaled across all modern enterprises. Full Story.

Current Affairs

Trump & Higher Education

Harvard University has become the center of political controversy as President Trump signed an executive order to cut off federal funding to universities that host international students. The new order, issued in February of this year, focuses federal agencies on monitoring international student speech and penalizing universities that fail to take disciplinary action against students who are considered to be expressing anti-American views. Full Story.

Swiss Glacier Landslide

On Wednesday, the village of Blatten in the Swiss Alps was buried after a glacier collapsed onto the town. The Birch Glacier, located in the Lötschental valley of Switzerland, released millions of pounds of debris, burying about 90% of the village. It has seen 6% of its total glacier volume disappear in 2022, and then 4% in 2023. Since 2000, glaciers in Switzerland have lost 40% of their total glacier volume. Full Story.

News

More from the Week

Trump says Powell is making a big mistake by not lowering rates in the first meeting of his second term. The Fed states that economic data will solely determine any rate movement.

The Oklahoma City Thunder are the 2nd youngest team to ever make it to the NBA finals. They return for the first time since 2012.

Elon Musk’s term within the Trump administration is coming to an end. The head of DOGE upended several government agencies, but failed to deliver generational savings.

Nvidia announced a 70% surge in quarterly revenue, reaching $44.1 billion, despite U.S. restrictions on its business with China.

Tottenham Hotspur celebrated a historic victory by winning the Europa League, marking their first major trophy in 17 years.

Read the full stories and more at theweeklyyield.com.